22/01/2025

22/01/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

22/01/2025

22/01/2025

Word and PDF

Word and PDF

2 to 3 pages

2 to 3 pages

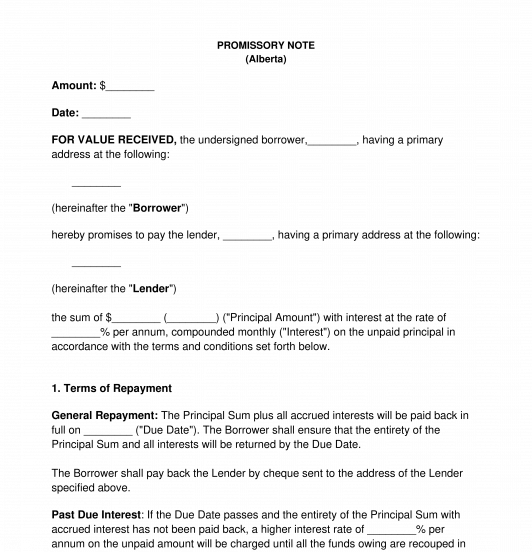

A Promissory Note, also sometimes called an IOU, is essentially an enforceable promise to pay back a loan or debt in which the borrower of money (the "Borrower") agrees to repay a lender (the "Lender"). A Promissory Note is different than a loan agreement because it only binds one party - the Borrower - to actions (such as payment) or consequences (such as if the Borrower doesn't pay), but it doesn't bind the Lender to anything. In fact, Lenders don't even sign Promissory Notes - only Borrowers do.

Often, Promissory Notes are used in place of more formal loans agreements when the loan is being made informally between friends or family members. Promissory Notes can even sometimes be used between very small businesses. When more formal loans are made between bigger businesses or banks, for example, that is when loan agreements are used.

How to Use this Document

This document can be used in any situation where an individual or business is borrowing money from another individual or business but is best used in situations where money is being loaned somewhat informally, between family or friends. This is because the Promissory Note is only signed by one party, the Borrower, and it does not bind both parties to an agreement.

In this document, the basic details of the loan will be entered, such as the amount and when the total amount is due. It also includes, of course, the identifying details of both parties: the name and address of the individual borrower and lender, or the business name and business address of a company borrower or lender.

This Promissory Note will also include a determination of the biggest issue with the loan - whether or not interest will be charged.

A Promissory Note is a short, succinct document for a loan. For a more detailed loan, an in-depth Loan Agreement can be used.

Applicable Law

Promissory notes are governed by federal legislation, specifically, the Bills of Exchange Act, RSC 1985, c. B-4.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Promissory Note - Sample, template - Word & PDF

Country: Canada (English)