04/11/2025

04/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.5 - 53 votes

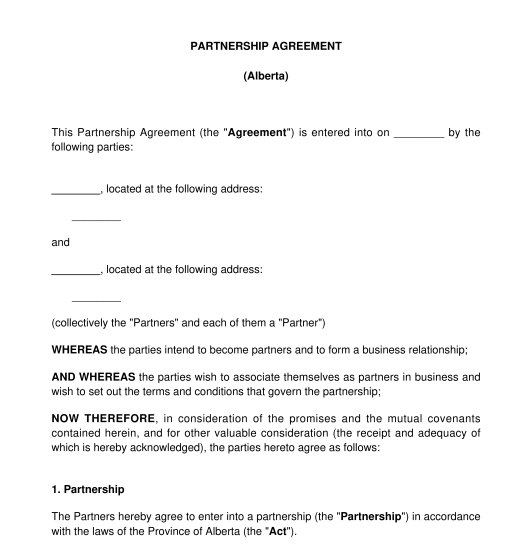

Fill out the templateA Partnership Agreement is a contract between two or more individuals, corporations, trusts, or partnerships (the partners) that join together to carry on a trade or business. In most partnerships, each partner contributes money, labour, property, or skills to the partnership. In return, each partner is entitled to a share of the profits or losses of the business. The business profits (or losses) are usually divided among the partners based on the partnership agreement.

There are three different types of partnerships:

A general partnership is the most common type of partnership, with all partners having equal rights and responsibilities. Limited partnerships usually are only used as investment vehicles, and the limited partners cannot take an active role in the business. Otherwise, they become general partners. A limited liability partnership is only allowed for certain professions. Therefore, the most common partnership is a general partnership.

Yes. An agreement is necessary, but it may be oral. In other words, a written agreement is not mandatory, but it is recommended. Having a written agreement in place allows the partners to specifically address the control of the business, management, profit sharing, and more.

Partnerships can be created by formal contracts, such as this Partnership Agreement. But even where no formal contract exists, the courts may find a partnership based on the characteristics of the relationship among the parties.

When no partnership contract is in writing and the partnership breaks down, the courts will decide the terms of the partnership which may not be what the parties intended.

Having an agreement in place ensures that the terms of the partnership agreement are what the partners intend them to be.

A Partnership Agreement should describe the partners' responsibilities, outline the ownership interest in the Partnership, outline each partner's profit and loss distribution, prepare the Partnership for common business scenarios, and include other important rules about how the Partnership will be managed. Also, the agreement should contain clauses on:

A minimum of two people must sign this agreement. The following may enter into a Partnership Agreement:

The above can enter into a partnership agreement if there is an intention to conduct business with a view to profit. It's important to note that the signatories to the agreement must be at least majority age.

Once a partnership agreement is ready, the partners must either meet in person to sign the document or they may circulate the agreement by way of email to electronically sign. A copy of the signed agreement must then be securely stored and uploaded to a personal computer. The partners will also need to fill out the required government form to register the partnership with the province or territory.

In every Province and Territory, some form of government registration is needed. It may be necessary for a partnership to register with the government by filing a registration or a declaration. These are usually prescribed forms and must include:

The declaration can be found on the provincial government website. If a partnership uses a trade name, the name must be registered with the government.

Partnerships are subject to provincial or territorial laws and common law. There are different types of partnerships which are subject to different laws. The following pieces of legislation apply to partnerships:

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Partnership Agreement - Sample, template - Word and PDF

Country: Canada (English)