17/09/2025

17/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

A General Receipt is a document by which one party can evidence that they received something from another party. Receipts are most often used in situations of sales, like the sale of goods or services. They can also be used for documents and monetary transactions (such as the fulfillment of a debt or other obligation) as well as donations.

After the invoice's fee is paid, the seller can deliver a receipt.

There are receipts for goods, services, donations, cash, and more. A goods receipt refers to a receipt for the purchase and sale of items. A service receipt relates to a receipt for services rendered by one party for another. A donation receipt is given by a charity or non-profit to a donor. A cash receipt refers to a receipt given to a person who gives cash to another person. Also, a landlord can provide the tenant with a rent receipt documenting the payment of rent. This is a separate, stand-alone document.

No. In general, having a receipt isn't necessary, but it's a good idea because it proves that a purchase was made. For Donation Receipts, if the donor wishes to obtain the tax benefits of their donation, they must obtain a receipt.

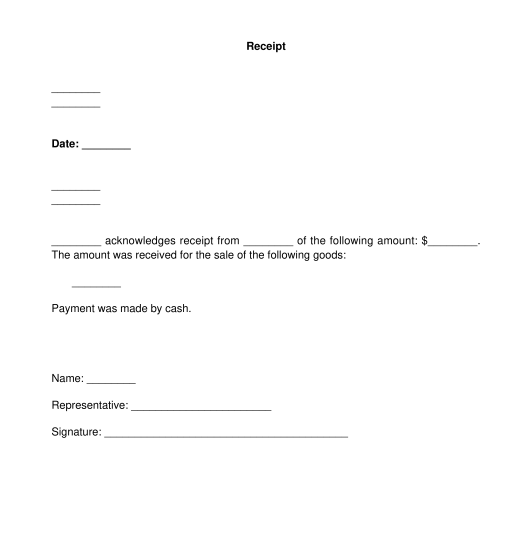

The general receipt should contain the name and address information for each party as well as the date of the transaction and information related to the goods or services purchased. The information should also include applicable taxes as well as the method of payment.

Once the receipt is ready, it must be given to the purchaser. The receipt can be given either electronically or physically. The entity providing the receipt must keep a record of the transaction for accounting and tax purposes. The entity providing the receipt should also keep a copy of the receipt in a secure location.

Under the Income Tax Act (R.S.C., 1985, c. 1 (5th Supp.)) and Canada Revenue Agency's guidance, specific requirements apply to Donation Receipts. The receipt must contain the name of the person receiving the money or items, the transaction date, a description of the items underlying the receipt, the amount paid if it was monetary, and how it was paid. Donation receipts also need to contain additional information about whether goods or services were exchanged for the donation.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

General Receipt - Sample, template - Word & PDF

Country: Canada (English)