20/01/2025

20/01/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

20/01/2025

20/01/2025

Word and PDF

Word and PDF

1 page

1 page

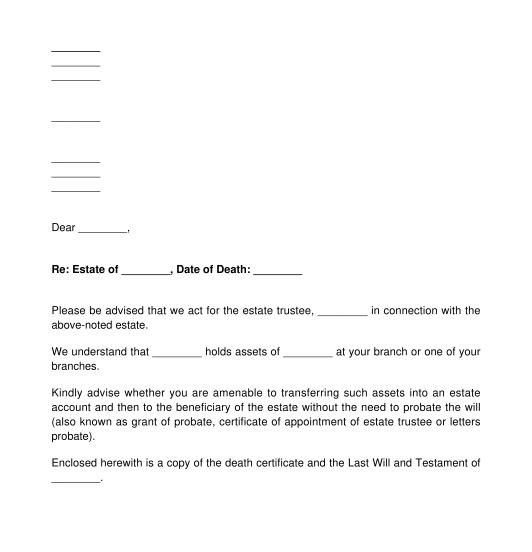

An Estate Trustee's Letter to Financial Institution Requesting Funds Transfer Without Probate is a letter that is meant to be sent by an estate trustee named in a will to a bank requesting funds to be transferred without the need to obtain probate. This letter serves the purpose of asking a financial institution (e.g. a bank) whether or not obtaining probate is necessary. Note that probate will likely be required.

This letter usually only applies when other assets of the estate do not need probate. In other words, a bank account is one of the only main assets and it would be ideal to avoid probate to save on costs.

This letter must contain:

Either the individual estate trustee named in the will, or the estate trustee's lawyer or other representative can use this document. The parties involved in this letter include:

(1) Estate Trustee: this is the individual named in the will of the deceased to administer the estate (also known as an executor). Administer the estate means dealing with the debts, collecting the assets, filing taxes, and taking care of all matters of the deceased.

(2) Beneficiary: these are the people named in the will who will inherit the property of the deceased. Often, an estate trustee is both the trustee and a beneficiary of the will.

(3) Financial Institution: this is the bank who will be receiving this letter and will confirm whether or not probate is needed. If the financial institution requires probate, the estate trustee will need to go through the process of probating the will of the deceased.

Once ready, the document may be sent to a financial institution that holds assets of a deceased person.

Once the bank branch receives this letter, they will notify the sender of the letter - either the individual estate trustee or their representative - whether or not they can transfer the money in the bank account into an estate account and then to the account's of the named beneficiaries in the will.

This letter should be mailed to the bank and a copy should be kept with all other estate documents.

This letter should be sent with a copy of the Last Will and Testament of the deceased as well as a Death Certificate of the deceased. If the letter is being sent by a representative of the estate trustee, the representative should have an authorization from the estate trustee signed and dated. If neither of these documents are available, this letter can be sent without them.

Probate means proving that the will of the deceased is their authentic last will. The process of obtaining probate involves submitting documents to a court along with the probate fee (also known as estate administration tax in Ontario), which is based on the value of the estate at death, with certain exceptions. Once done, the will is stamped with a court seal and is authenticated. More often than not, banks and other institutions will require probate before they are wiling to deal with an estate trustee. However, at times, probate may not be necessary and a financial institution may consent to transferring funds without it.

The law depends on the Province or Territory. For example, in Ontario, probate requirements are established in the Estate Administration Tax Act, 1998, S.O. 1998, c. 34, Sched. In situations where the estate is contested (i.e. litigated), probate is required.

If probate is needed, the estate trustee of the deceased is under a legal obligation to pay the required probate fee (also known as estate tax, which is not to be confused with income tax).

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Country: Canada (English)