16/10/2025

16/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

16/10/2025

16/10/2025

Word and PDF

Word and PDF

1 page

1 page

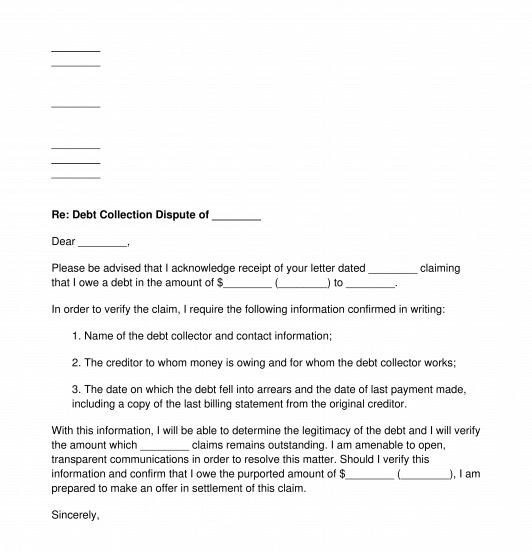

This document is intended to be used by the debtor (the business or individual owing money) who will send the letter to the collection agency that originally contacted them to obtain more information about the debt.

This collection agency has been hired by a creditor (the person or business that is owed money).

Collection agencies work on behalf of creditors to help them collect debts that are owing by the debtor (the person or business not making payments).

In short, there are three parties involved:

(1) A creditor;

(2) A debtor; and

(3) A collection agency.

This letter is intended to obtain from the collection agency all relevant information about the debt. The letter will also make an offer to settle the debt at a lower amount. If the collection agency is not cooperative and is unwilling to settle, the debtor may decide to pay the money owing or may choose to have the matter seen in court.

Creditors may often agree to a lower amount in order to settle the amount owing, especially if the cost of collecting the full amount of the debt exceeds the settlement offer.

How to Use the Document

When a collection agency contacts a person who owes money, more information may be needed. This letter is intended to gather and confirm information in writing if not already done. Furthermore, if a collection agency wrote a letter to a person who owes money and there is missing information, this document may be used to obtain the necessary details, and to make an offer to settle the amount of money at a reduced rate.

This letter should be sent by registered mail, as it can be tracked online. Otherwise, the letter can be sent by ordinary mail or email. The debtor should keep a copy of this letter for their records.

Applicable Law

Under Canadian law, if the debt owing is to a federally governed institution (for example, a Bank), debt collection rights arise. Each Province will have its own laws. For example, in Ontario, if the debtor or the collection agency are located in Ontario, the Collection and Debt Settlement Services Act, R.S.O. 1990, c. C.14 applies. This piece of legislation governs collection agents and debt settlement service providers.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Debt Collection Dispute Letter - Sample, template

Country: Canada (English)