15/09/2025

15/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

15/09/2025

15/09/2025

Word and PDF

Word and PDF

1 page

1 page

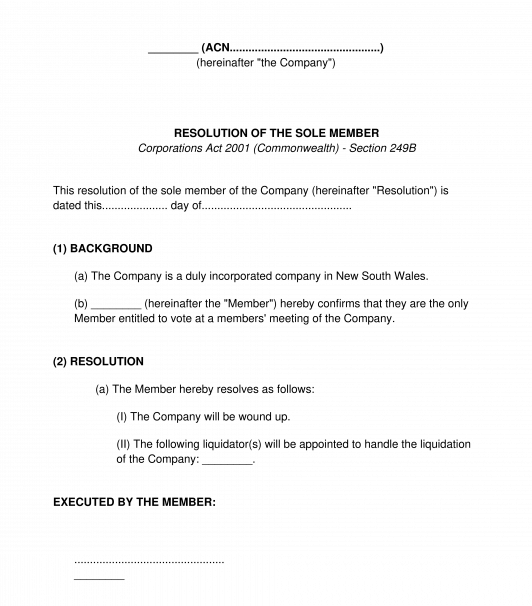

This Resolution to Wind up a Company is for use when a company is being wound up (in other words, the company is being shut down).

This document may be used by companies with a single member ("single-member" companies), or those with multiple members ("multi-member" companies). It may be used for resolutions passed at a meeting, or in some cases, it may be used to pass a resolution without having a meeting.

In addition to the resolution to shut down the company, the document contains options to include some other resolutions. For example, some companies that are shutting down choose to pass some other resolutions at the same time, such as resolutions to terminate some contracts, or sell some equipment.

For more general resolutions, consider using our Members' Resolution (for Private Company). For general resolutions which are passed at a members' meeting, consider using our Minutes of Shareholders' Meeting document. For directors' resolutions, consider using our Directors' Resolution document. For general resolutions which are passed at a directors' meeting, consider using our Minutes of Directors' Meeting document.

Winding up a solvent company

This document is designed for use by a solvent company (a company which is able to meet its debts and financial obligations). It is not designed for use by an insolvent company. If a company is in financial difficulty or is at risk of being insolvent, it should seek professional advice as soon as possible. Companies must not trade while insolvent. Trading while insolvent can result in civil or criminal penalties under Australian law.

If a solvent company is going to be wound up, there are a number of steps that need to be taken. This document only deals with part of the process. The Australian Securities and Investments Commission (ASIC) provides further information about what else needs to happen.

However, an important part of the process is that the company members must pass a special resolution to wind up the company. This means that at least 75% of the members of the company must vote in favour of the resolution at a meeting. Or, if the resolution is being passed without a meeting, then all of the members entitled to vote on the resolution must vote in support of it. This document is designed to be used for this very important step in the process.

Public company or private company

As this resolution has the capacity to be used without a meeting (a circulating resolution), it is only designed for use by private companies (also known as proprietary companies). Under the Corporations Act 2001 (Commonwealth), (the "Act") public companies cannot use circulating resolutions. Instead, the members in public companies must meet in person in order to pass a resolution.

ASIC provides further information about private and public companies.

For a more general discussion about starting a business in Australia see our guide How to Start a Business in Australia. For a discussion of some other legal structures in Australia, see our guide How to Choose the Best Legal Structure for your Business.

Meeting or no meeting

As discussed above, this document may be used with or without a meeting.

However, whether or not the company needs to have a meeting or not will depend on the relevant law, as well as the relevant company rules (such as the rules set out in the constitution).

Section 249A of the Act permits resolutions to be passed by multi-member companies without a meeting, if all the members entitled to vote on the resolution sign a document containing a statement that they are in favour of the resolution set out in the document. Section 249B of the Act permits resolutions to be passed by single-member companies by recording the resolution and signing the record.

However, even though these sections 249A and 249B of the Act say that the company may pass a resolution in either of these ways, it is possible that the company's constitution and/or shareholders agreement might actually state that for this particular company, some other procedure must apply. For example, for a multi-member company, the constitution might state that the members must actually hold a meeting.

Therefore, it is important that the person preparing this document first consults the company's constitution and shareholders agreement (if applicable), to confirm whether either document sets any additional procedural requirements for the passing of resolutions generally, for the passing of special resolutions, and for the winding up of the company.

If not holding a meeting - the document must be signed by all members entitled to vote on the resolution

Section 249A of the Act clarifies that for a resolution to be passed without a meeting, all of the members entitled to vote on the resolution must sign the document. Therefore, if the resolution is going to be passed without a meeting, all of the members entitled to vote on it (ie 100%) must sign the document.

Further information is available from ASIC.

How to use this document

There are several steps in the process for winding up a solvent company. ASIC provides further information about the necessary steps.

The first step is that the directors of the company must make a declaration of solvency, using ASIC Form 520. A declaration of solvency means that the directors believe the company will be able to fully pay its debts within 12 months of the commencement of the winding up.

After that, the members of the company need to pass a special resolution to wind up the company, and the company must appoint a liquidator. A liquidator is an experienced accountant who is appointed by the court, the company members or the directors to wind up the company. They review the company's financial position, sell assets and distribute money to creditors. They also provide reports to regulators such as ASIC in some circumstances.

This is normally done at a members' meeting. Before the meeting, the members must be given adequate notice of the meeting, and of the proposed special resolution. Our Notice to Call Members' Meeting can be used for this. Once the meeting occurs, this Resolution to Wind up a Company document may be used to record the proceedings of the meeting and to record the special resolution to wind up the company.

Alternatively, in some cases, companies pass this special resolution without a meeting. However, this can only be done if the company constitution and any shareholders agreement permits the proposed resolution to be passed without a meeting - so make sure to check these documents before proceeding. Or if in doubt, make sure to call a members' meeting and deal with the resolution there.

If the special resolution to wind up the company is being passed without a meeting, then this Resolution to Wind up a Company document can be circulated to all members, so that they can sign it and confirm that they agree with the special resolution. The document will need to be signed by all members entitled to vote on the resolution(s). Unless the constitution and/or shareholders agreement state otherwise, the members may all sign and date the same copy of the document, or the document may be signed in counterparts (meaning each member signs and dates a different but identical copy). The resolution is passed when the last member signs it.

Once the resolution has been passed, the company must lodge ASIC Form 205 (Notification of resolution) setting out the text of the resolution that was passed. The liquidator must also lodge ASIC Form 505 (Notification of appointment or cessation of an external administrator). Then the company can publish a notice of the resolution on ASIC's published notices website. The liquidator can begin winding up the company, taking account of the assets and liabilities of the company.

If there are any concerns at any stage of the process, seek legal advice.

Applicable law

The Corporations Act 2001 (Commonwealth) applies to many company matters, including members' meetings and winding up of a company.

In some cases, the Income Tax Assessment Act 1936 (Commonwealth) may also apply.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Resolution to Wind up a Company - sample template

Country: Australia