21/09/2025

21/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

21/09/2025

21/09/2025

Word and PDF

Word and PDF

1 to 2 pages

1 to 2 pages

These Minutes of Directors' Meeting can be used to record what has happened at a directors' meeting, including which resolutions have been passed. If the directors are passing a resolution without a meeting, use our Directors' Resolution document instead.

These Minutes, once prepared and signed, will constitute the company's formal record of what happened during the meeting. In the event of a dispute, Minutes may be used in court to prove or disprove whether the directors have satisfied their fiduciary duties.

The Corporations Act, company constitution, and shareholders' agreement are all relevant

Under the Corporations Act 2001 (Commonwealth), (the "Act") most of the decisions that affect a company need to be made by a resolution.

Part 2G.1 of the Act deals with various aspects of directors' meetings, including such matters as how the meeting may be called, the use of technology for the purpose of the meeting, chairing the meeting, quorum at the meeting, and the passing of resolutions.

However, these rules can often be overridden by the company's constitution or shareholders agreement (if applicable). In fact, in many companies, the company's constitution or shareholders agreement will provide different rules which apply to directors' meetings.

Therefore, it is important that the person preparing this document consults the company's constitution and shareholders' agreement (if applicable), as well as the Act, to confirm whether either document sets any additional procedural requirements for directors' meetings.

Further information is available from the Australian Securities and Exchange Commission.

Ordinary resolutions or special resolutions

There are several kinds of resolution that may be passed at a directors' meeting: ordinary resolutions and special resolutions.

Ordinary resolutions are not specifically defined in the Corporations Act and need only a simple majority (ie normally, more than 50% of votes cast in favour) to pass.

Special resolutions are needed for certain changes as defined in the Act. Special resolutions usually require at least 75% of votes cast in favour in order to pass. In addition, there are specific requirements for the form of notice that must be provided ahead of a meeting where a special resolution is going to be proposed.

In particular, if a special resolution is being proposed at a meeting, the notice to members must include the intention to vote on the special resolution and details of its contents. This is in addition to the other standard requirements like providing a date and time, proxy information, etc.

Normally, ordinary resolutions may deal with more basic matters, such as election/re-election of director, appointment of an auditor, and acceptance of reports at the general meeting. On the other hand, decisions like changing a company's name, winding up the company, or changing the company's type will typically require a special resolution.

Use this document for multi-director companies

Since companies with a single director ("single-director" companies), do not usually have an actual directors' meeting, these Minutes are only designed for use by companies with multiple directors ("multi-director" companies).

Single-director companies may use our Directors' Resolution document instead, which deals with the passing of resolutions without a meeting.

Use this document for directors' meetings, but not for members' meetings

It is important to note that under the Act, some kinds of decisions must be made by a members' resolution (ie shareholders' resolution), rather than a directors' resolution.

Generally speaking, directors' resolutions relate to the day to day running of a company. For example, a decision to enter a particular contract, or to grant or revoke somebody's signing authority, may be made by directors' resolution.

On the other hand, members' resolutions may be required for decisions that relate to the fundamental details of the company, rather than day to day business matters. For example, decisions relating to the following matters generally require a members' resolution rather than a directors' resolution:

However, different rules may apply to different types of company. In addition, the company constitution and shareholders agreement (if there is a shareholders agreement) might also say something about how certain decisions must be made (ie whether they should be made by directors or members, and by ordinary resolution or special resolution). Therefore, if in doubt, seek legal advice.

This document is only intended for use in the case of directors' resolutions. It is not appropriate for the types of matters that require a members' resolution.

How to use this document

Review the company constitution and shareholders' agreement (if the company has a shareholders' agreement) to check for any particular rules or procedural requirements that relate to directors' meetings.

It may be necessary to check whether the proposed resolutions can be decided by directors' resolution, and whether they must be passed by special resolution or ordinary resolution. It may also be necessary to make sure that proper notice is provided for the meeting, in accordance with the Act and with the company's constitution and shareholders' agreement.

These Minutes, once finalised and signed, constitute the company's formal record of what happened during the meeting. Therefore, it is important that the Minutes actually reflect what occurred during the meeting.

We have provided a list of common resolutions which may be added to the Minutes. We also provide the option to write one or more customised resolutions.

Our common resolutions cover matters such as:

However, if the wording of our common resolutions does not accurately reflect what happened in the meeting, then they should not be used. In these circumstances our customised resolutions may be used instead.

Once the Minutes have been prepared, they should be approved by the directors, as a true record of their meeting. In many cases, companies do this by emailing the Minutes to the directors after the meeting, so that the directors can check them. At the following meeting, the directors can then confirm that they approve those Minutes (from the previous meeting), and the chairperson can sign those previous Minutes. Once the chairperson signs the Minutes, only clerical errors may be amended.

Section 251A of the Act requires that the Minutes be entered in the directors' minute book within one month of the meeting.

In addition, for many types of resolution, the Australian Securities and Investments Commission requires specific forms to be lodged. Further information, as well as links to the relevant forms, are available on the webpage of the Australian Securities and Investments Commission under the heading "Once a special resolution has been passed, what forms need to be lodged?".

Applicable law

The Corporations Act 2001 (Commonwealth) applies to many company matters, including directors' meetings.

In some cases, the Income Tax Assessment Act 1936 (Commonwealth) may also apply, for example when dealing with a public officer.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

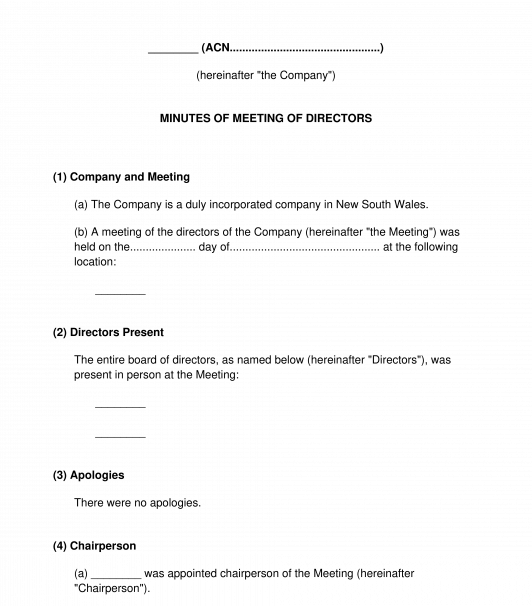

Minutes of Directors' Meeting - sample template

Country: Australia