23/09/2025

23/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

23/09/2025

23/09/2025

Word and PDF

Word and PDF

1 page

1 page

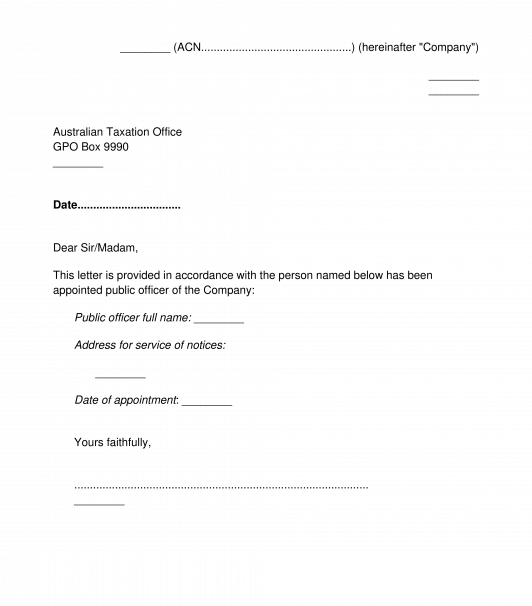

This Letter to the Commissioner of Taxation can be used to announce the appointment of a public officer, which companies are required to do under Australia's Income Tax Assessment Act 1936 (Commonwealth).

A public officer is a company's official point of contact for matters involving the Australian Taxation Office (ATO). Section 252 of the Income Tax Assessment Act 1936 (Commonwealth) (the "Act") requires a company to appoint a person to the position of public officer within three months of the company commencing business or deriving income in Australia.

Under section 252(c) of the Act, the public officer is not "appointed" until the Commissioner of Taxation has been given written notice specifying the name of the public officer and an address for service of the public officer. This letter may be used to provide that notice to the Commissioner of Taxation.

A person must meet certain criteria in order to be eligible for the role of public officer. In particular, the public officer must be:

- at least 18 years old; and

- ordinarily a resident of Australia; and

- capable of understanding the nature of their role as public officer.

Once appointed, the public officer also incurs some important legal responsibilities. Further information about public officers is available from the ATO. When a company appoints a public officer, the public officer also needs to provide their consent. Our Consent to Act as Public Officer may be used for this purpose.

Use this letter to notify the Commissioner of Taxation at the ATO that about a company's appointment of a public officer.

Fill out the relevant details where prompted. Some details are optional, such as an email address or phone number for the public officer.

But some details are mandatory, including the name of the public officer and the address for service of notices on the public officer. The address for service of notices refers to an address where formal notices can be sent by the ATO. This should be an address that is routinely monitored, because the company will be deemed to have received a notice if it has been sent to that address (even if nobody from the company has actually checked the mail box at that address).

The ATO's postal address is GPO Box 9990 in each capital city in Australia. Therefore, if the sender of this letter is based in regional NSW, their closest postal address for the ATO will be GPO Box 9990 in Sydney, which is in the 2001 post code.

Once these details have been provided, the letter can be signed by a representative of the company (such as a director) and can be sent to the Commissioner of Taxation at the ATO.

The company should also keep a copy of this letter on file, as evidence that they have notified the ATO. In addition, the public officer needs to provide consent to being appointed as public officer for the company.

Australia has the Income Tax Assessment Act 1936 (Commonwealth) and the Income Tax Assessment Act 1997 (Commonwealth), both of which apply to income tax matters in Australia.

The Corporations Act 2001 (Commonwealth) applies to company matters in Australia.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Country: Australia