22/09/2025

22/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

22/09/2025

22/09/2025

Word and PDF

Word and PDF

1 page

1 page

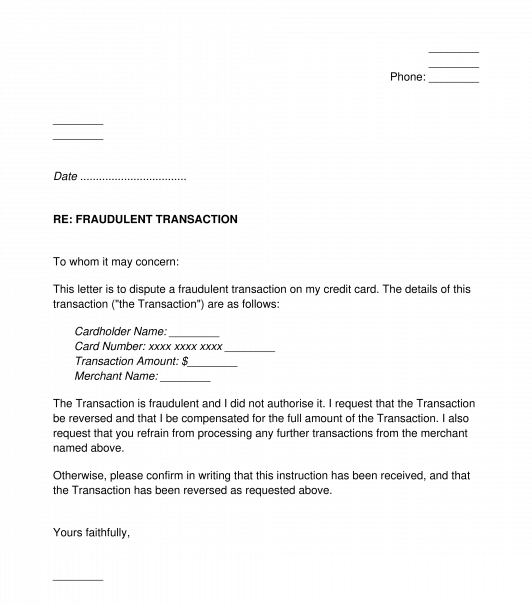

This is a letter to a bank or other financial institution, to dispute a fraudulent credit card transaction. The primary purpose of this letter is to give the bank the information it needs, regarding the customer and their account, to notify the bank of the fraudulent transaction, and to request that it be reversed.

If a person wants to dispute a fraudulent transaction, then they may notify their financial institution in writing. Once the financial institution receives this request, they may investigate the transaction. They may prevent subsequent payments being made to the same merchant, and in some cases the account holder may be able to obtain compensation for the amount of the transaction.

When we refer to a "fraudulent" transaction or an "unauthorised" transaction, we are talking about charges showing up on a credit card statement, even though they have not been approved by the credit card holder.

Please note that if the person preparing this letter is not disputing a fraudulent transaction or an unauthorised transaction, but simply wants to put a stop to a direct debit arrangement which they have set up in the past, then they may use our Letter to Bank to Cancel Direct Debit.

How to use this document

In this letter, the sender will enter pertinent details about each of the parties - both the credit card holder, and the bank or financial institution which issued the credit card.

There is a space for the sender's name and address, as well as email (if desired) and phone number, so that the financial institution may reach the sender easily. There is also a space for the contact information of the financial institution, and optional spaces for a name and title of an individual person, if the sender knows of a specific person of whom to send the letter.

The sender may then enter information about the fraudulent transaction such as the name of the merchant, the relevant account details, the amount of the fraudulent transaction, and the date of the transaction.

Once the letter has been completed, it can be sent to the financial institution. The sender may keep a copy for their own reference.

Applicable law

The National Consumer Credit Protection Act 2009 (Cth), and in particular the National Credit Code, which appears in schedule 1 of that Act, deals with consumer credit in Australia.

Further information and guidance can also be obtained from the Australian Securities and Investments Commission ("ASIC") and from ASIC's Moneysmart website.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Country: Australia