20/10/2025

20/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

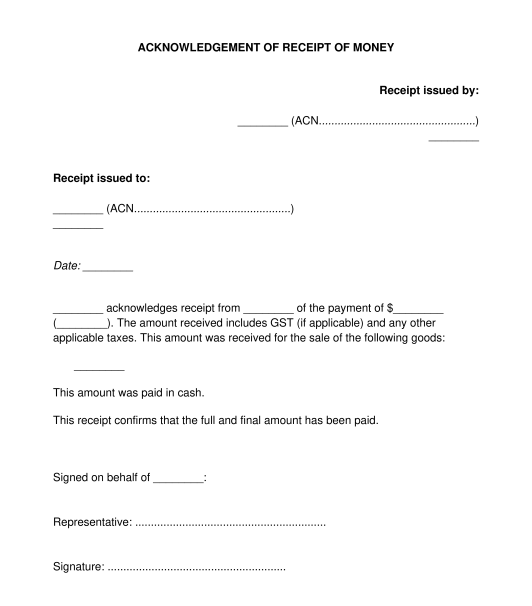

A General Receipt, often simply known as a "Receipt", is a document by which a person or business provides written acknowledgement that they received something from another person or business.

Receipts are most often used in situations of sale, such as a sale of goods or the provision of services. Receipts may also be provided for documents and monetary transactions (such as the fulfilment of a debt or other obligation) as well as charitable donations.

This General Receipt is for use in a wide range of situations, such as a sale of goods or the provision of services. It may also be used for documents and monetary transactions (such as the fulfilment of a debt or other obligation) as well as charitable donations.

On the other hand, a Rent Receipt is specifically designed for a landlord to provide a tenant after receiving rent for a property. It has more specific terms related to the rental property.

A General Receipt is used to provide proof that something has been received, whether payment, goods, documents or something else.

A Tax Invoice is used to request payment. The sender is able to provide detailed information about the goods or services that have been provided, as well as specific information as required under Australian taxation laws.

Under the A New Tax System (Goods and Services Tax) Act 1999 there are some additional requirements regarding the provision of a Tax Invoice (rather than a Receipt). The Australian Taxation Office provides guidance in relation to tax invoices.

Businesses must provide a Receipt to consumers for anything that costs over $75. For anything that costs less than $75, the consumer can ask for it and the business must provide it within 7 days.

Ideally, the General Receipt should be handed over at the same time that the relevant thing has been received. It should not be handed over beforehand, as it serves as proof that the thing has actually been received.

Under section 100 of the Australian Consumer Law, if a business is required to provide a Receipt, then it should be provided as soon as practicable after the goods or services have been provided.

The General Receipt should be printed, then signed by the issuer of the Receipt. The issuer of the Receipt may wish to take a copy for their records. The original signed Receipt should then be given to other party, preferably at the time that the relevant thing (whether money, goods, services, documents or something else) is actually received.

It is also good practice to ask for the Receipt to be signed by the other party as this will confirm the statements set out in the Receipt.

For businesses that are providing Receipts to consumers, the Receipt must contain:

Section 100 of the Australian Consumer Law requires suppliers to provide a receipt to consumers for anything that costs over $75 (excluding GST). For anything that costs less than $75, the consumer can ask for it and the business must provide it within 7 days. The Australian Competition and Consumer Commission also provides some guidance.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

General Receipt - sample template online - Word and PDF

Country: Australia