19/01/2025

19/01/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

19/01/2025

19/01/2025

Word and PDF

Word and PDF

1 page

1 page

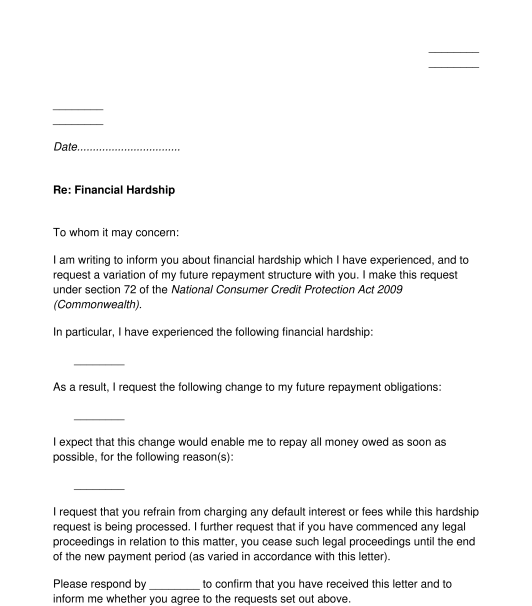

This Financial Hardship Letter is for use by a person who is experiencing financial hardship, and who is having difficulty meeting their financial obligations as a result of that hardship (the "Sender"). The letter can be sent to a person or organisation to whom repayments are owed (such as a bank or other lender) (the "Receiver").

Using this letter, the Sender may provide a clear explanation of their situation, and how this has caused them financial difficulty. The Sender may then request a variation to the repayment structure, and may propose a structure that is more manageable for the Sender. The Sender can then explain how the proposed new structure would enable them to repay all of the money owed.

By getting on the front foot and proposing a realistic solution to the Receiver, the Sender of the letter presents a responsible and professional image to the Receiver. In turn, the Receiver may be more likely to agree to the Sender's requested variations, and in doing so, to refrain from imposing interest or late fees, or commencing legal action.

Unlike our Letter to Debt Collector, this letter can be used to notify anybody of the Sender's financial hardship, whether or not that person has been in contact with the Sender to demand payment.

Enter enough details to enable the Receiver of the letter to understand the Sender's circumstances, and to be satisfied that the debt will be repaid if the Sender's requests are granted. This may include information about the Sender, the nature of the hardship, the proposed change to the Sender's repayment obligations, and an explanation of how this will enable the Sender to repay the debt.

Generally, a Receiver of this letter is more likely to agree to any requested variations if the requests are reasonable, and if they can realistically be expected to result in the Sender of the letter repaying the entire debt within a reasonable timeframe.

In addition, if the Sender of this letter requests variations to their repayment schedule, and then also fails to meet those new payment obligations, then the Receiver of the letter may be more likely to take aggressive debt recovery action against the Sender. Therefore, many Senders of this letter find it preferable to find the middle ground, requesting a repayment structure which the Receiver of the letter will think is reasonable, while also being something that the Sender can actually manage.

Once the letter has been prepared, print several copies. One copy may be sent to the person or organisation to which the money is owed, and from which the Sender is requesting a variation in the repayment obligations. Most lending institutions will have an internal dispute resolution department. The letter may be sent to this department. The Sender of the letter may keep a copy of the letter for their own records.

The National Credit Code, which is contained in Schedule One of the National Consumer Credit Protection Act 2009 (Commonwealth) applies to consumer credit in Australia. Sections 72-75 of the Code specifically deal with hardship variations.

In addition, general principles of contract law, as provided by the common law, may apply to any loan contract.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Financial Hardship Letter - sample template

Country: Australia