11/10/2025

11/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

11/10/2025

11/10/2025

Word and PDF

Word and PDF

7 to 9 pages

7 to 9 pages

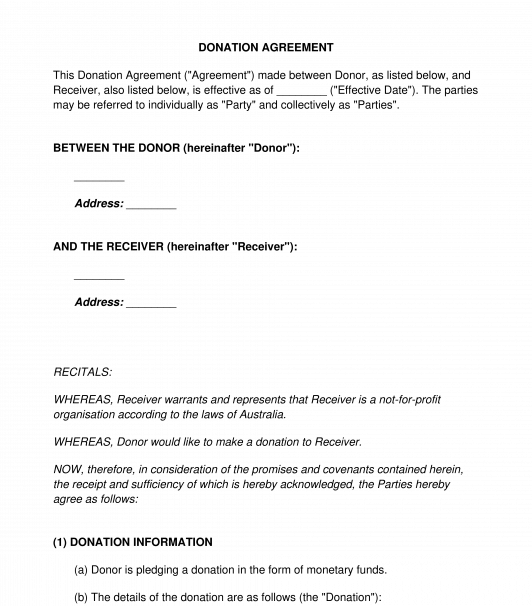

A Donation Agreement, also sometimes called a Charitable Gift Agreement, provides written proof for a donation, or gift, that has been given to a not-for-profit organisation in Australia. A Donation Agreement is important for both parties to the contract: the not-for-profit organisation (often called the receiver) and the person or entity donating (often call the donor). The not-for-profit organisation must keep accurate records of donations received, but so must the donor keep records of the donations they have given. Having accurate financial records on file will help both parties in their internal record-keeping and also when it comes to tax time.

In a Donation Agreement, the most important details of the parties' relationship will be entered: things such as the parties' identities, a description of the donation, and, if desired, things like the form of the receipt that was given and the intended use for the donation. A good Donation Agreement will also discuss revocability (whether the donation can be taken back) and expense responsibility.

How to use this document

This document can be used for a company or person who is getting ready to donate to a not-for-profit organisation. Various identifying details can be entered, such as whether the parties are individuals or businesses, their contact information, and, of course, all of the details of the donation, including its monetary value.

Not-for-profit organisations are organisations that provide services to the community and do not operate for the profit of their members. All profits of the organisation must be used for the services that the organisation provides, and must not be distributed to members, even if the organisation is wound up.

Charities are a subset of not-for-profit organisations. Some not-for-profits are able to register as charities, but not all charities are not-for-profits. Further information is available from the Australian Charities and Not-for-profits Commission and the Australian Taxation Office.

After this document is filled out, it should be printed so that both parties can sign it. Then, a best practice is for both parties to keep a copy.

Applicable law

Fundraising, not-for-profits and charities are highly regulated in Australia.

The Charities Act 2013 (Commonwealth) deals with charities at a federal level.

In addition, each state and territory of Australia has its own fundraising laws. This means that if an organisation is fundraising in only one state or territory (for example, by holding an in-person fundraising night) then it might only need to comply with the laws of that state or territory (and possibly the local council regulations).

However, if the fundraising is happening in several states and territories, the organisation may need to comply with the laws of each of those different states and territories. If fundraising is taking place online, then the organisation will need to consider whether this amounts to fundraising in multiple states and territories, and therefore whether the organisation will need to comply with multiple sets of fundraising laws.

In some cases, not-for-profit organisations will need to be registered with the Australian Charities and Not-for-profits Commission.

In addition, the Australian Consumer Law, which addresses matters such as misleading and deceptive conduct and unconscionable conduct, may also apply.

For specific fundraising activities such as trade promotions, raffles, lotteries, sweepstakes and similar gaming activities, special laws may also apply.

Further information is available from the Australian Charities and Not-for-profits Commission. If in doubt, seek legal advice.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: What to do after Preparing a Contract

Donation Agreement - sample template - Word and PDF

Country: Australia