15/12/2025

15/12/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.6 - 58 votes

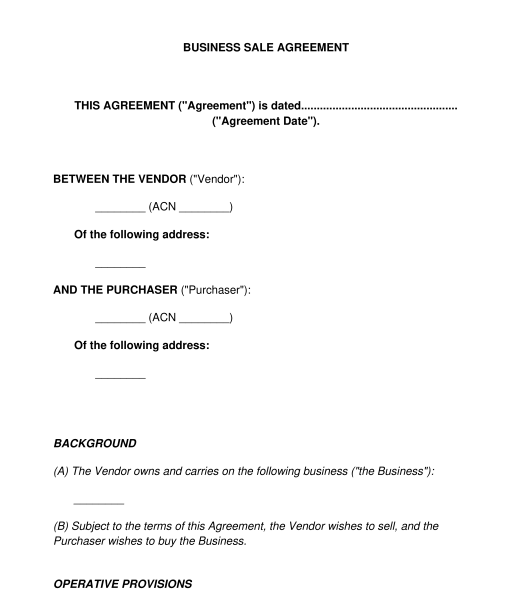

Fill out the templateThis Business Sale Agreement is for use when the owner of a business sells the business to a new owner. A Business Sale Agreement allows the parties to outline the terms and conditions of the sale.

There are two main types of Business Sale Agreement:

There are many different factors and many moving parts in a business sale, so going ahead without a written Business Sale Agreement can be a recipe for chaos.

If something goes wrong during the sale process, then it can be very difficult for either party to enforce their rights unless there is a written Business Sale Agreement in place.

For tax and other administrative purposes, it can also be necessary to have a Business Sale Agreement to show the relevant authorities as evidence that the sale has occurred.

The assets of a business are all of the things owned by the business. These can be both tangible, like physical equipment, furniture, stock and inventory, or intangible, like trademarks, patents, recipes or brand names.

This refers to assets of the business which are creations of the mind, such as trademarks, logos, brand names, literary or artistic works, recipes designs or symbols.

These are promises made by the seller to the buyer about the state of the business. If the warranty turns out to be untrue, then the buyer will have legal remedies against the seller.

These are a way to allocate risk between the buyer and seller. For example, the seller often indemnifies the buyer for any legal claims relating to the operation of the business up until the date that the buyer takes over the business. This means that if somebody makes a legal claim against the business for something that happened before the date of sale, the seller would be responsible for it and would cover any of the buyer's costs related to dealing with that claim.

Before entering this Business Sale Agreement, the buyer should conduct their due diligence on the business. They should research the market and the financial status of the business. They should investigate whether the business is subject to any current or pending legal claims, or whether it is facing bankruptcy. They should also investigate the current assets and liabilities of the business and try to obtain a full picture of the business's value.

Once they have done this, the parties should negotiate the terms of the business sale. To maintain the confidentiality of the negotiations, they may choose to use a Confidentiality Agreement (also known as an NDA). Once they come to a loose agreement, but before they are ready to sign this Business Sale Agreement, they may also choose to prepare a Memorandum of Understanding to outline (in a non-binding manner) the parties' general understanding about the sale. This can enable both parties to then go away and get the ball rolling on things such as applications for loans, permits or seeking professional advice.

Once the Agreement has been prepared, both parties should carefully review it to make sure it reflects their needs. Businesses can vary drastically in nature, meaning the requirements for business sale agreements also vary significantly. If the parties are happy with the Agreement, then it should be signed by both parties and dated. Once completed and signed by all parties, this Business Sale Agreement constitutes a binding agreement between the parties, enabling them to start making arrangements for the business to be handed over.

Both parties should keep a copy of the signed and dated Agreement. The parties should also pay close attention to any relevant timeframes which are set out in the Agreement, and should make sure they understand what they each need to do, and when they need to do it.

If any conditions are included in the agreement, then those conditions will also need to be met in order for the transaction to go ahead. If they are not, then one party or the other (or in some cases, both parties) may have the right to pull out of the agreement.

There are many moving parts in a business sale, so if the parties have any doubts, uncertainties or concerns, then they should seek legal advice.

No, witnesses are not mandatory for a Business Sale Agreement, but they are useful for evidentiary purposes. If there is ever a dispute over the Agreement, witnesses can help to prove that each party's signature is valid.

Witnesses should be independent adults (aged over 18), who have the mental capacity to understand what they are doing. They should not be related to one of the parties.

The Agreement should address a variety of matters that may be relevant to a business sale, including:

General principles of contract law, as provided by the common law, will apply to this Agreement.

Depending on the industry within which the business operates, other bodies of law, specific to that industry, may also apply.

If employees are being transferred with the business, then elements of employment law may apply. For example, the Fair Work Act 2009 (Commonwealth) deals with matters such as accrued annual leave and long service leave when a business is sold.

If intellectual property is being transferred with the business then elements of intellectual property law can apply, such as the Trade Marks Act 1995 (Commonwealth), or the Copyright Act 1968 (Commonwealth).

While it is common to include a restraint of trade clause in a Business Sale Agreement, if the restraint of trade goes further than the basic protection of the buyer's legitimate business interests (and amounts to some kind of attempt to carve up or manipulate a market) then the parties may also need to consider the cartel provisions of the Competition and Consumer Act 2010 (Commonwealth), which deal with anti-competitive or cartel conduct.

If in doubt, seek legal advice.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Business Sale Agreement - sample template

Country: Australia